Week #44, 2024

Week 44 of 2024 has arrived. The crunch of leaves is ever present when I walk outside these days. Eventually we will get some rain, and the decomposition process will start in earnest. Everything is cycles.

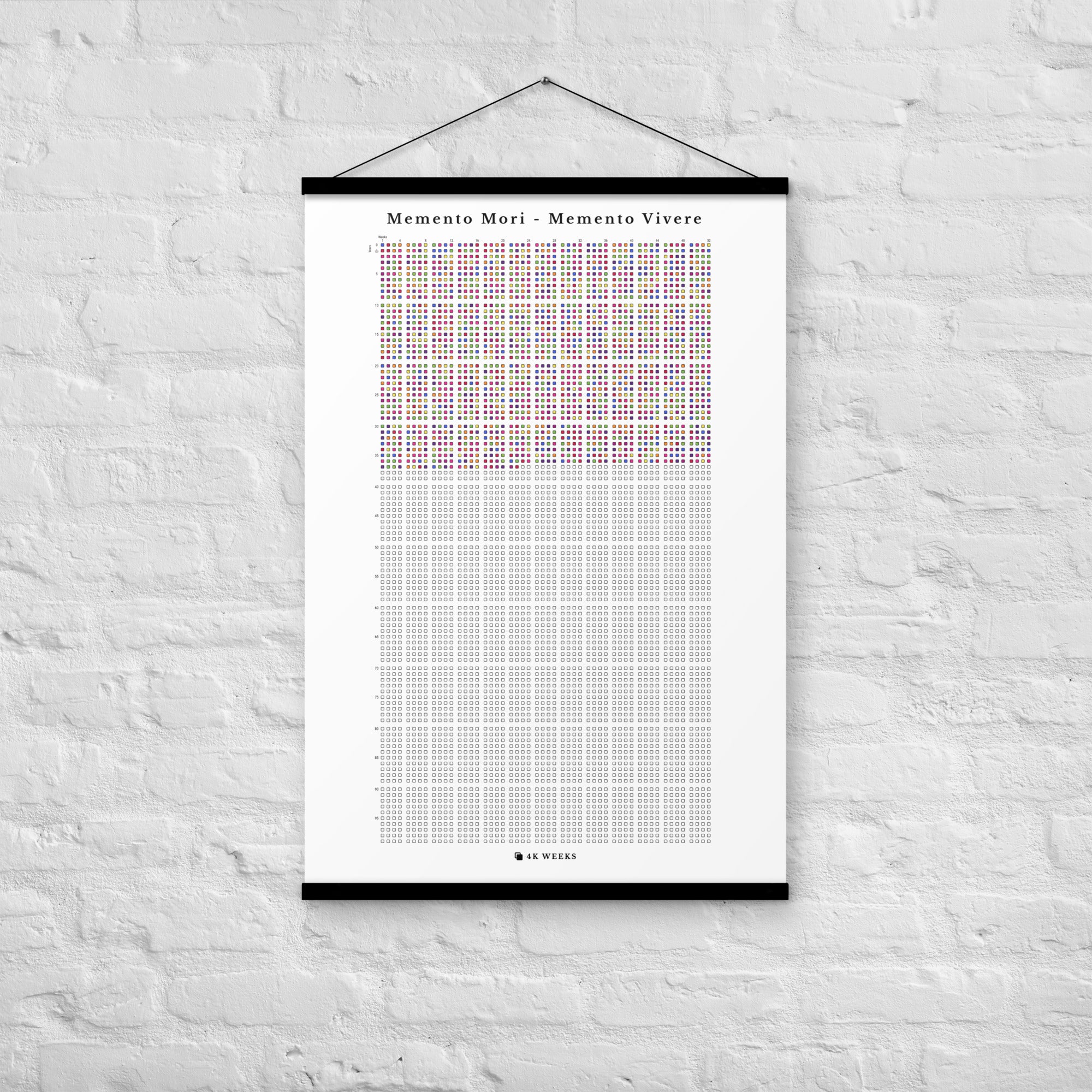

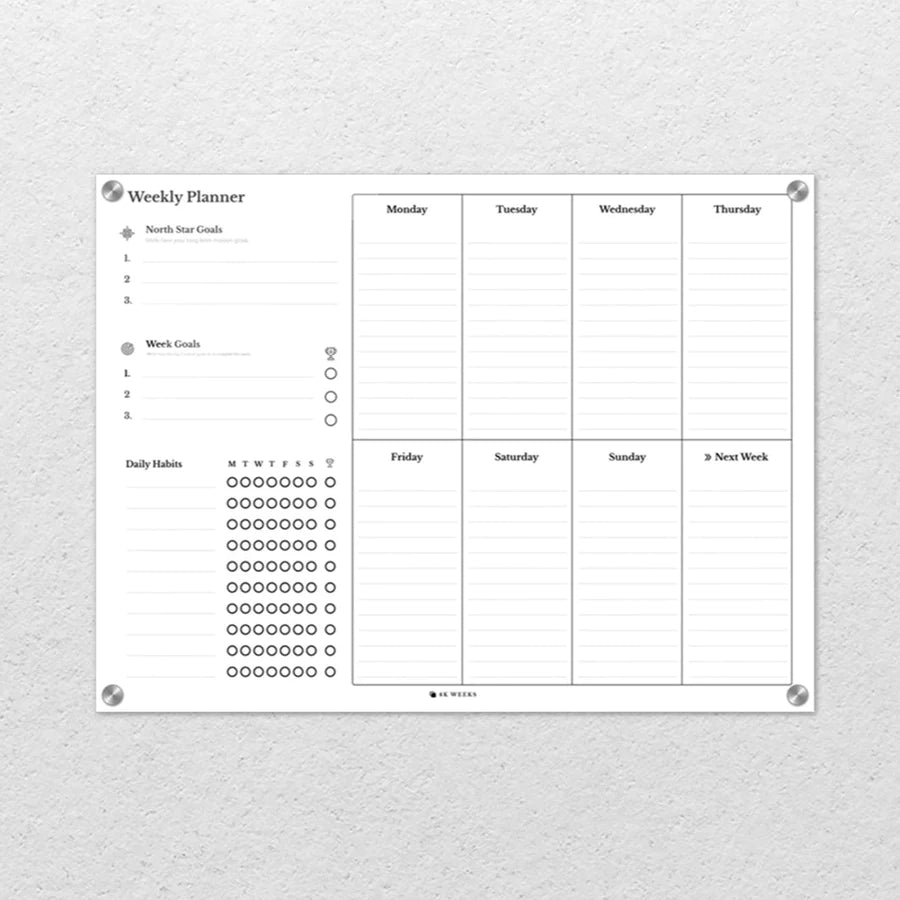

Time to walk over to your 4K Weeks poster and fill in another square. Done?

I am back at my desk, just shy of a month since I last sat here. While I was gone, I stopped nearly every habit that I had previously... the good ones and the bad ones. This was intentional. My body needed an "off season" to heal some persistent aches, and I knew that my work habits had shifted more to the "activity" column and out of the "progress" column.

to make adjustments on the fly, and it is also hard to disappear for a month and come back to a blank slate. Either way, I would encourage you to take a hard look at what you are doing all day long. It is SO easy to fool yourself into thinking you are doing the important work of your life when actually you are just checking off to-do items.

The important work is usually the easiest to procrastinate.

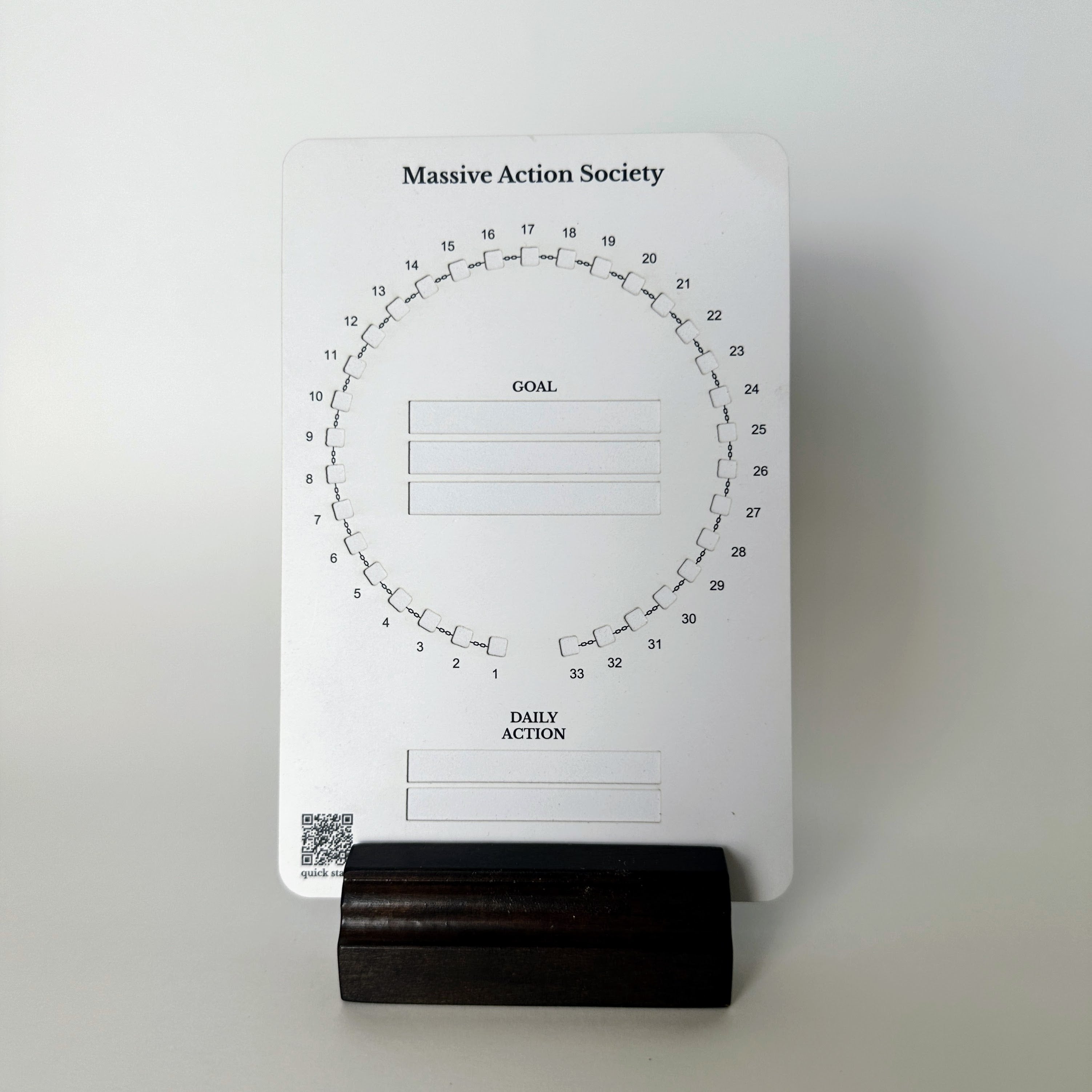

When you are ready, here is how I can help you make progress on the things that are important to you: the 33 Day Foundation will launch in November. If you want to get on the wait list, send Eli a message with "33" in the subject

|

Listen to this blog as a podcast! Search "4000 Weeks #44" in your app. |

Remarkable Weeks

Week 44 of 1938, Orson Welles caused panic across the United States when he read War of the Worlds on the radio. The science fiction novel about a spaceship from Mars landing on Earth, written by HG Wells, was presented in a realistic format that created panic and chaos. He was 1,225.57 weeks old (23.50 yrs).

Week 44 of 2006, Shakira became the first female artist to win Record of the Year, Song of the Year and Album of the Year during the 7th annual Latin Grammy Awards. She was 1,552.14 weeks old (29.76 yrs).

Week 44 of 2008,Barack Obama became the first African-American U.S. President. He was 2,465.57 weeks (47.28 yrs).

This Week's Quote

"Always seek out the seed of triumph in every adversity." -Og Mandino

Failure is nearing peak fetishization. I don't know where it started, but likely it was some slick magazine profile of some tech billionaire's rise to success.

The fact is, it doesn't matter if it is failure or success... everything you do should be under the microscope at some time or another. There is a lesson in everything, even when things are going well. Find it, and use it to grow.

What I am Consuming This Week

The Dragonbone Chair, Tad Williams. Before we left town I searched for "books similar to Game of Thrones". This book, the first in a trilogy, was highly recommended, and even served as a bit of inspiration for G.R.R.M. It's really good.

I have been really getting interested in AI and how it will change our world. Yesterday in my Mastermind group, we agreed that we were all having trouble visualizing how AI would change everything, but that in 10 years it would be obvious in hindsight.... Here are some things I have been consuming on AI.AI Agents coding for you.

A Masterclass to Achieve more with GenAI.

Hard Fork Podcast Powerful A.I. By 2026?

What I am Thinking About This Week

This is the sixth in a series of posts about how to get your crap in order. Some of these may not apply to you, and that’s great… congratulations. But… I know that I find new value in Epictetus’s Enchiridion every time I read it, so review can be good, too. I am treating this as a sidecar to Maslow’s Hierarchy of Needs, and all of it comes from my own personal journey these 47 years. I think that you have to add your own personal flavor to each of these pillars, but the fundamentals are sound. If you have thoughts, I would love to hear them.

Savings/Freedom

I am going to talk about money. The only reason I am talking about money is because in this culture, in this moment, it is freedom. If you disagree, you’re either wrong or arguing something different. If you find yourself annoyed/dismissive/bored, etc., you might want to think about your underlying beliefs regarding making money. You can’t both loathe a thing and attract it, simultaneously.

Also, I know everyone is in different situations. This isn’t about getting rich… although it is the beginning of nearly every "self made rich person's" story. It’s about creating some space between what you need to spend to live and what you earn. The space between how much money you have and how much money you spend is where freedom lies.

I should say - none of this is financial advice - just the story of what worked for us, and some things that I think anyone who is struggling should think about and decide for themselves. We are all grown-ups, and we are all responsible for our own decisions.

When my wife and I were married 17 years ago, we had debt and almost no savings. Student loans, credit cards, mortgage, etc… I was struggling to get the studio to make any money, and she had a pretty good job in advertising. Neither of us come from money, and so there we were, floating adrift as adults in a culture where keeping up with the Joneses is one of the only unquestioned beliefs. We kept trying to figure out how we could make more money, but making money is hard, and it takes time. When you are young it seems like the future will never come. So for a while, we treaded water and lost ground.

And then, one night we went to dinner with a couple. They were, it seemed, miles ahead of us in the grown-up department. One of them had just made partner, increasing his income by about 4x per year. Insane money to us at the time. But… partners were paid quarterly profit shares, not salary, and that night they mentioned that money was tight and they were having trouble getting the bills paid for the last few weeks of the quarter.

On the ride home, Ryann and I were incredulous. And that’s when it hit us… almost everyone spends 100-110% of what they make. Being broke is usually not an income problem. It is usually an expenditure problem. And certainly… even if you do truly not make enough money… if you have bad habits, no amount of “more money” will give you freedom, but if you have good habits, you likely won’t be hand to mouth for long.

After we had that realization, we got a financial planner and bared our shameful, debt-ridden souls to him. Once we had someone to be accountable to we started saving, first paying off all consumer credit, and then saving, and saving, and saving.

It was slow at first, not even enough to really matter. But we stuck with it. Every time money showed up, we auto-debited it to an investment account that was hard-ish to access. Seriously… we got a new internet service that was $30 cheaper, I created a $30 auto debit. Ryann got a raise, I created an auto debit. Every single time that we increased our income over the previous month, I created an auto debit. My thinking was that we didn’t need it last month, so we won’t need it this month. It wasn’t easy at first… I called it budgeting by starvation... If there wasn't money in the checking account, we couldn't spend it. but eventually we noticed that the amount we were saving each month made us happier than having a fancy car. (Sidebar: You shouldn’t have a car loan. Period. The only good debt other than a mortgage is business debt that is making money. It makes zero sense to pay interest on a depreciating asset.)

This created space and a bit of freedom. Because if you make $100,000 a year, and you have $100,000 in savings, then you can afford to quit. And if you don’t HAVE to go to work… it makes it much easier to actually go to work.

Strive to spend significantly less than what you make. It’s hard. It’s hard not because you will go without… the things that truly make you happy probably aren’t that expensive. It’s hard because you won’t be strutting your tail feathers and “high status” for all to see. If you drive a rusty 2008 Honda and have $3 million in the bank, people will assume you are poorer than the guy struggling to make the payments on his 2024 Porsche. It is still work for me to remind myself that I don’t need these people to know my wealth. I have to remind myself daily to opt out of the culture of keeping up with the Joneses. The status game is everywhere.

In a nutshell: Save money and stop trying to impress people with your stuff. You need to do this both because it will give you freedom, and because you need to practice not caring what other people think about you.

If you like your job, are enjoying your life, and you are saving $50 for every $100 you bring in, sweet. That is freedom. John Goodman said it best… with a few expletives.

It is pretty simple... not super easy, but not complicated. We are people of action... so, if you need a plan, here is one you might try:

1) Pay off your high interest debt! Seriously, tighten the belt, and eat rice and beans until you aren’t paying 30% interest on last year’s bar tab.

2) Reduce your monthly expenses for a bit. For example... If you have a car loan on a newish car, consider getting rid of it and buying something from the 2000’s that is less than $5000. Consider it a stoic test. You can always park far away and walk if you are super embarrassed. (Once you CAN afford a new car and still drive an older model, it will be a badge of honor)

3) Save $2000 and put it in a savings account at a high interest online bank. (Wealthfront, Betterment, etc) One where you can transfer it into your checking account if you need to, but it will take a few days. This is your emergency fund. It is only for repairing the car, paying for the emergency room, etc… Most things aren't emergencies.

4) SAVE, SAVE, SAVE, MOARRRR! Find joy in providing for your future self, not your present self. It is a fun game to see where you can “find” money to save. At first this money should go into the cash account, and eventually, when you feel like you are no longer “broke”, you can start transferring monthly amounts into low fee index funds. (You can’t beat the market, don’t try.)

5) Hustle. This works better if you are young… it is much harder to start things if you need to hold a baby at the same time. (I'm not saying it's impossible, but it will be a heavier lift!) This is not me saying you should spend a ton of money importing widgets from China only to lose $10,000 that you earned hourly. Any hustle should pay for itself. Invest a nominal amount in your hustle ($500?, $1000? Your risk tolerance is up to you), leave all the money in the business account and let it roll.

6) Once you are on track (see the amount you should have saved by what age here) then you can decide what freedom really means to you.

Thoughts? Disagree? Let me know.

Next week… Life Philosophy/Creativity

Spencer

Dad Joke O' The Week

Did you hear about the cheese factory that exploded in France?

Da brie is everywhere!

Other articles:

Quick Links

Affiliate Products

We participate in various affiliate programs, and some of the links on our site may pay a comission at no cost to you if you order a product that we recommend.

Leave a comment: